108 REAL ESTATE EXTENDED THE LEASE FOR NN GROUP IN THE ZLATÝ ANDĚL BUILDING

Our office team successfully supported NN Group in negotiating a lease extension in Prague's iconic Zlatý Anděl building.

Our office team successfully supported NN Group in negotiating a lease extension in Prague's iconic Zlatý Anděl building.

Automation is a must in logistics, and almost all logistics companies are counting on it at least in part in the coming years, whether they plan to deploy autonomous handling technology, mobile robots or start working with artificial intelligence. This was confirmed by this year's Trends in Czech Logistics survey, which was prepared by Ipsos for the Society of Competent Logistics and Suppliers (SKLAD). Representatives of this society and one of their customers met in September in a debate of Hospodářské noviny to present the news on the logistics automation market.

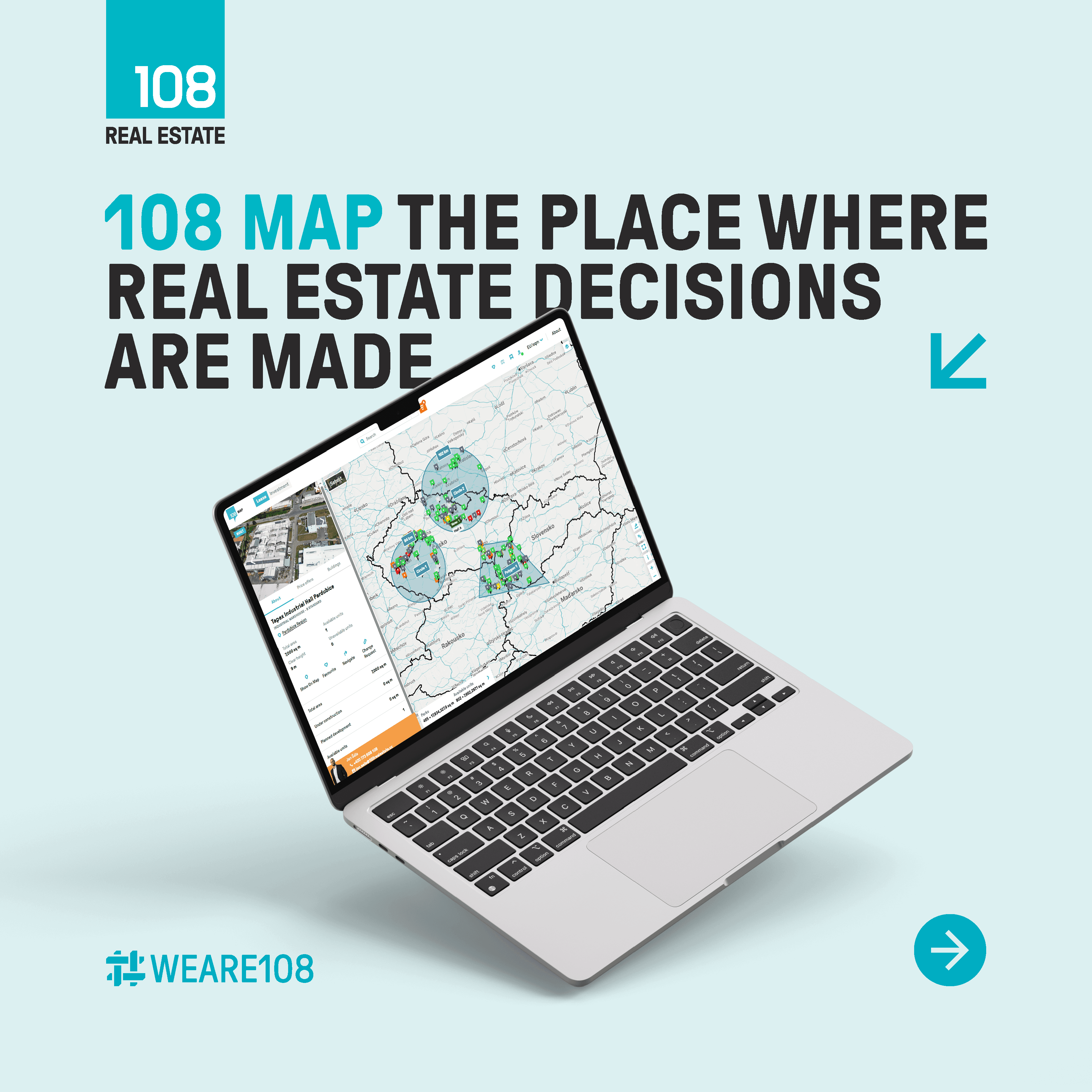

Not all maps are created equal. While some only show dots on a page, our brand-new 108Map delivers context, detail, and real estate logic. It gives you a comprehensive view of the industrial property market, helping you find the right solution for your business – whether it’s an industrial space for lease, a warehouse unit, or a logistics hall.

On Sunday, September 14, 2025, the charity run Run, Bekim! Run! took place in Pezinok, showing that movement can unite hearts and change lives. This charitable event attracted us not only as donors but also as part of a community that believes in the power of sport and helping others.

Our traditional informal gathering once again lived up to expectations - and it's all thanks to you, our wonderful guests. There was plenty of beer, even more tartare and wings, and above all great company and good cheer.

We are pleased to introduce the all-new 108 Map - a data map of the industrial real estate market that has not only been given a new visual coat of paint, but more importantly, new features. And above all: for the first time, we are also opening it up to all partners involved in industrial projects.

Today, we discovered our very own "beige club of four" - four colleagues who arrived in the same colour tone without any agreement. 🎨We agreed that beige is the new black.

PZP HEATING a.s. is a leading Czech manufacturer of heat pumps and systems for energy-efficient heating with a long tradition and strong market position.

Almost 190,000 sqm of modern industrial space was leased under new contracts in the Czech Republic in the second quarter. After taking into account renegotiated contracts, the total realised demand for warehouse and production space in the Czech Republic from April to the end of June was 337,625 sqm. In terms of new leases, the past quarter thus surpassed the beginning of this year. The data was published by real estate consultancy 108 REAL ESTATE.